People Data Analytics

Data is the key to unlocking all of the HR opportunities that your business may not have recognised yet.

It is a sad truth that HR has never been seen as the “data powerhouse” of an organisation. Covid was a huge catalyst in forcing companies to embrace a level of digitalisation that may have taken them another decade to get on board with.

However, it’s becoming increasingly clear with a data-first mindset, organisations have a huge opportunity to level up their proactivity and experience better-informed decision making.

Simplifying complexity.

Ensuring compliance.

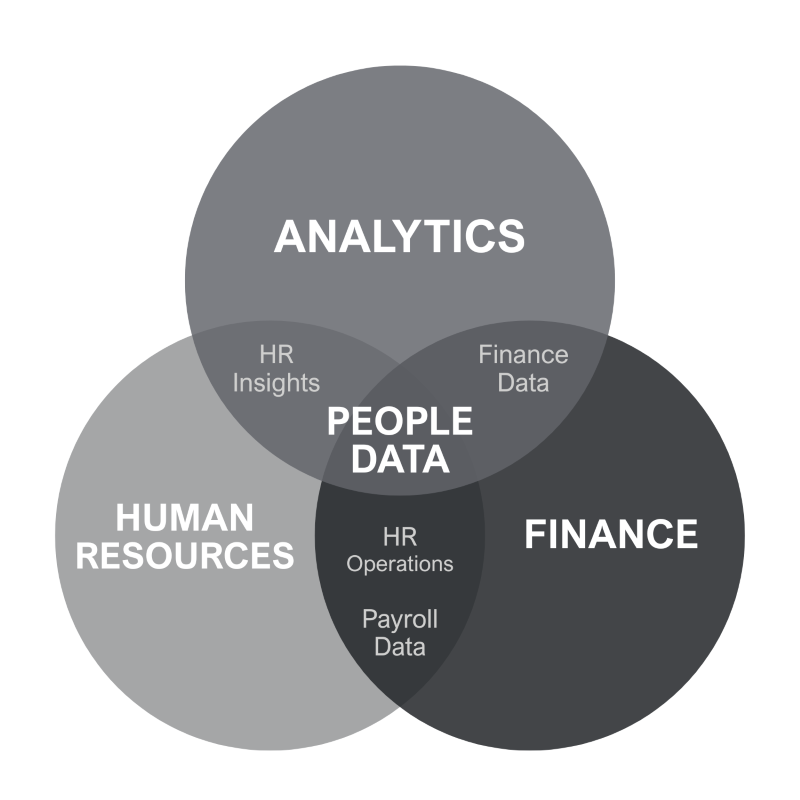

Have you heard the term ‘People Data Analytics’ but are not quite sure how it fits in with HR?

People Data is the data that sits in the sweet spot between your Finance, Analytics, and HR departments.

Our People Data Analytics consultants can help you transform your HR, payroll, and engagement data into strategic insights - empowering you to identify risks, improve employee experience, reduce turnover, and optimise workforce performance through data-driven decisions.

Payroll Audits

At FiveSeven Consulting, our Data Analytics Specialists focus on conducting internal payroll audits that not only identify past payroll errors but also help organisations align with the Fair Work Ombudsman’s Payroll Remediation Program Guide.

Whether you’re preparing for a formal remediation program or proactively reviewing your payroll processes, our audits are designed to help employers correct errors, rebuild trust with employees, and meet compliance expectations with confidence.

-

A historical payroll audit is a detailed review of payroll data across past pay periods to identify and rectify:

Underpayments or overpayments

Incorrect application of award conditions

Leave accrual issues

Inaccurate classifications or entitlements

Missing allowances or penalties

This process supports employers in remediating past payroll errors in a structured, defensible, and Fair Work-aligned way.

-

The Fair Work Ombudsman (FWO) outlines best practices for remediation in its Payroll Remediation Program Guide, encouraging employers to:

Acknowledge errors

Conduct robust audits

Communicate transparently

Accurately calculate entitlements

Repay affected employees fairly and promptly

Our audit methodology is purpose-built to support this framework, helping you build a defensible position and demonstrate good faith efforts to comply.

-

This is the ideal starting point for businesses who aren’t sure whether a full audit is necessary.

What we do:

Review a sample of your payroll data (e.g. select roles, departments, or time periods)

Assess compliance against relevant awards, agreements, and the Fair Work Act

Identify any early indicators of underpayment risks or entitlement misalignment

Provide initial financial estimates where issues are identified

Evaluate data quality and system readiness for a full audit

At the end of Stage 1, you’ll receive a Preliminary Payroll Compliance Report. If Stage 1 findings are minor, you may not need further analysis. But if systemic issues are found, we’ll help you take the right next step: efficiently, thoroughly, and compliantly.

-

This stage involves a comprehensive review of your payroll records across a defined period, covering all relevant employees, classifications, and entitlements in line with Fair Work and award obligations.

What’s included in Stage 2:

Full data collection and cleansing

Mapping of entitlements under applicable awards or agreements

Recalculation of historical pay, allowances, loadings, and leave

Identification of underpayments, overpayments, or misclassifications

Calculation of back pay

Employee-level outcomes report

Executive summary with compliance findings and financial exposure

Recommendations for remediation, process improvements, and risk mitigation

-

Our approach to Stage 2 is fully aligned with the Fair Work Ombudsman’s Payroll Remediation Program Guide, ensuring that the audit is conducted in good faith, findings are transparent, and remediation is accurate, fair, and defensible.

We can also assist with:

Preparing communication plans for affected employees

Coordinating repayments or adjustments

Liaising with internal stakeholders (e.g. HR, legal, finance)

Implementing ongoing controls and internal review tools

Enterprise Agreement Analysis

Understanding and applying the correct award or enterprise agreement is one of the most challenging and critical aspects of payroll compliance.

That’s why we offer tailored EA or Award Quick Guides ('Cheat Sheets') designed to break down the complexity and help your payroll, HR, and rostering teams stay on track.

At FiveSeven, we provide expert consulting services to help you analyse, interpret, and implement Enterprise Agreements with confidence.

-

Each customised cheat sheet summarises key entitlements and provisions relevant to your business, such as:

Classification levels & definitions

Ordinary hourly rates

Penalty rates (weekends, evenings, public holidays)

Overtime rules

Minimum shift lengths and breaks

Allowances (e.g. travel, uniform, meal)

On-call, recall or sleepover provisions

Casual loading, part-time rules, or flex terms

Common compliance risks or misinterpretations

Links to the full Award/EA and Fair Work guidance

Delivered in a clear, easy-to-reference format; perfect for managers, payroll officers, and schedulers.

-

We tailor each cheat sheet to your:

Industry and job roles

Applicable Award or EA

Workforce structure (casual, part-time, full-time)

Relevant clauses or variations in your EA

Optional: Add-on support interpreting grey areas or clauses needing clarification

-

As a reference tool during rostering or onboarding

To brief new payroll or HR staff

As part of internal audits or compliance checks

To identify entitlements during remediation projects

To reduce risk of future underpayments or misinterpretation

-

With each cheat sheet, we also offer a "compliance risk snapshot" highlighting areas in the Award or EA most commonly misapplied, based on Fair Work cases and audit experience.

Get in touch.

Are you ready to solve? Our agile approach provides on-demand support, when and where it is required, to improve your business performance.

Call our team today for a free, confidential 30-minute consultation.